What is the so-called US debt ceiling? 1:15

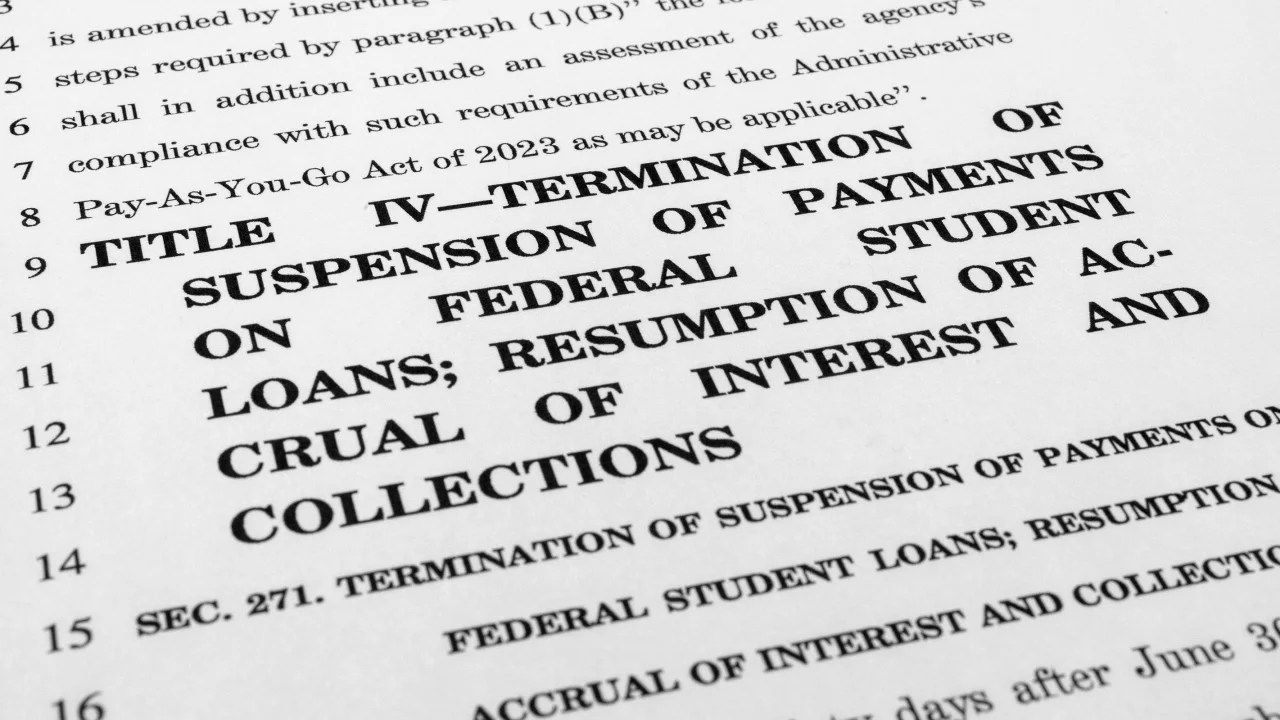

Washington (CNN) -- If the bipartisan debt ceiling agreement becomes law, it will dash any hopes borrowers might have had of a ninth federal pause on student loan repayments.

The Biden administration has repeatedly said the pause in federal student loan payments due to the pandemic would end by the end of this year, but officials have said that before and extended the pause again.

- Manchin could get a pipeline from debt ceiling deal, and environmental advocates are furious

This time, Education Secretary Miguel Cardona may not be able to do so. The agreement to address the debt limit includes a provision that specifically prevents it from extending the pause in payments again, according to the text of the bill.

The pause "will cease to be effective" 60 days after June 30, according to the bill.

This roughly coincides with the Biden administration's plan to resume payments 60 days after June 30 or 60 days after the Supreme Court rules on the student loan forgiveness program, whichever comes first. The Court is expected to deliver its ruling in late June or early July.

The student loan forgiveness program promises up to $20,000 in debt relief for low- and middle-income borrowers if the Supreme Court allows it to go ahead. Although House Republicans have previously voted to block the program, a bill Biden has vowed to veto, the debt ceiling deal leaves it in place.

advertising

- What is the debt ceiling in the US and why is the threat of default so worrisome? What you need to know

Resuming payments will be an unprecedented task

When the pause ends later this year, about 44 million people will have to repay their federal student loans, and there is some concern about whether the process will go smoothly.

Many people may be confused about how much they owe, when to pay, and how. Millions of borrowers will have a different servicer in charge of their student loans since the last time they made a payment. Non-payment may result in commissions.

- This contains the agreement on the debt ceiling in the US.

Congress allocated the federal Office of Student Aid about $800 million less than the Biden administration had requested for this year, keeping the office's operating budget the same as last year, even though there will be more work to do. Some student loan servicers have recently cut back on customer service hours, raising fears that resuming payments will be a bumpy process.

Student loan experts recommend that borrowers contact their student loan servicer with any questions about their loans as soon as possible, especially if they are interested in enrolling in an income-based repayment plan. These plans, which set payments based on income and family size, can reduce monthly payments but require borrowers to submit some documents.

Federal student loan borrowers can check the FSA's website for up-to-date information on resuming payments.

- Everything You Need to Know About Biden's Student Loan Forgiveness Program

Student loan forgiveness still on the table

All eyes are on the Supreme Court as borrowers wait to see if the Biden administration is allowed to move forward with its student loan forgiveness program.

Under the proposal, individual borrowers who earned less than $125,000 in 2020 or 2021 and married couples or heads of household who earned less than $250,000 a year could receive up to $10,000 forgiveness of their federal student loan debt.

If a qualified borrower also received a federal Pell grant while enrolled in college, the individual is eligible for a forgiveness of up to $20,000.

- Pell Grants in the U.S.: What They Are, Who Is Eligible, Requirements, How Much They Pay, and How to Apply

But several lawsuits argue that the Biden administration is abusing its power and using the covid-19 pandemic as a pretext to fulfill the president's election promise to write off student debt.

So far no debt has been cancelled. But if the Supreme Court allows the program to take effect, it's possible the government could move quickly to forgive the debts of 16 million borrowers the government has already approved for relief.

If the justices strike down Biden's student loan forgiveness program, it's possible the administration will make some policy changes and try again, though that process could take months.

Student loansdebt ceiling