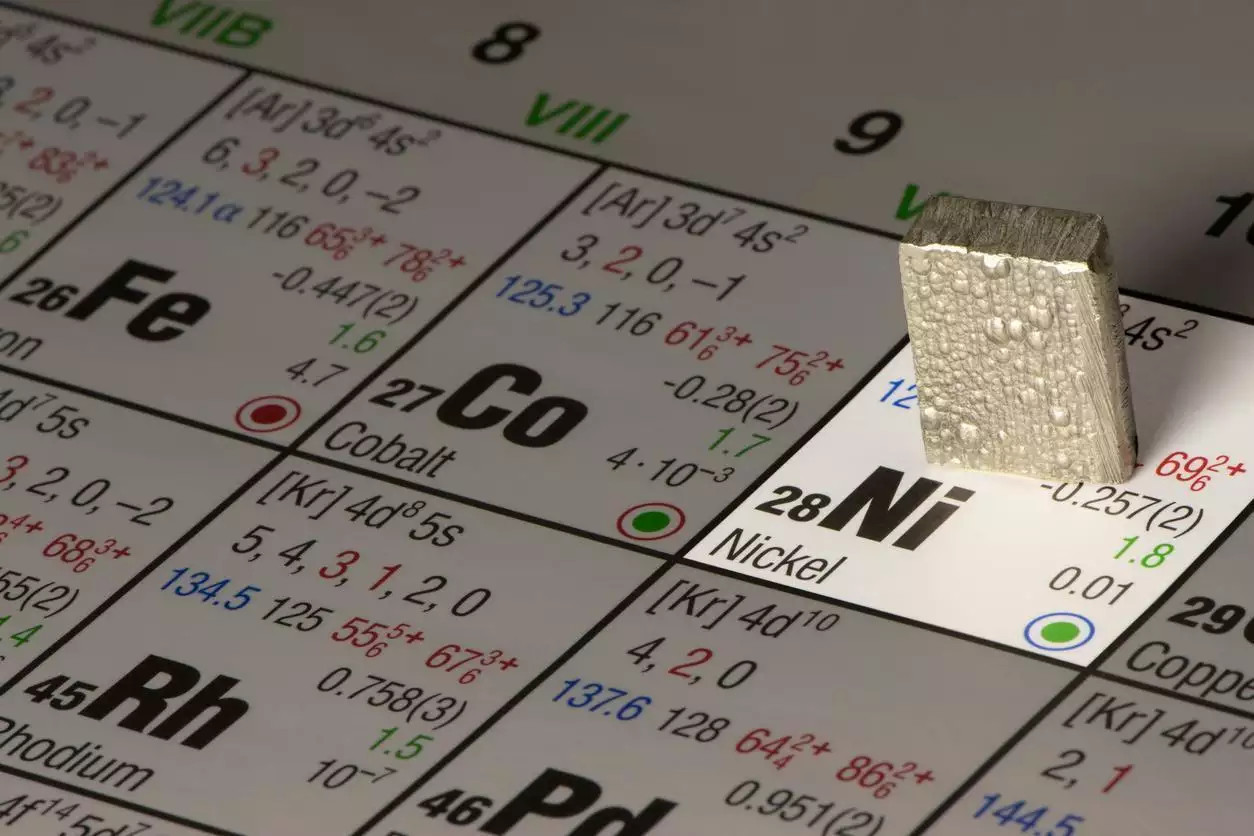

Metal stocks on six major contracts on the London Metal Exchange (LME) fell to their lowest level since 1997.

APA-Economics reports quoting Bloomberg that this increases the risk of further rise in prices for metals.

The stock market has been criticized for halting the nickel market and canceling billions of dollars in trade after a 250% price increase.

UK regulators have already begun reviewing LME's activities.

It should be noted that in recent weeks, the LME has made radical changes to its rules to address the risk of depletion of stocks, including the introduction of a rule that allows owners of "short" positions to avoid deliveries.

Thus, after the reduction of nickel reserves, a limit of 15% was applied to the daily price corridor of metals.

Recall that on March 8, the price of nickel more than doubled to $ 100,000 per ton for the first time in history, so the exchange suspended trading in the metal for several days.

Later, the LME allowed the trading of nickel under certain rules.