The central bank recalled that the three banking crises in the United States in recent years were all related to the Fed's sharp increase in interest rates.

(Photo by reporter Chen Meiying)

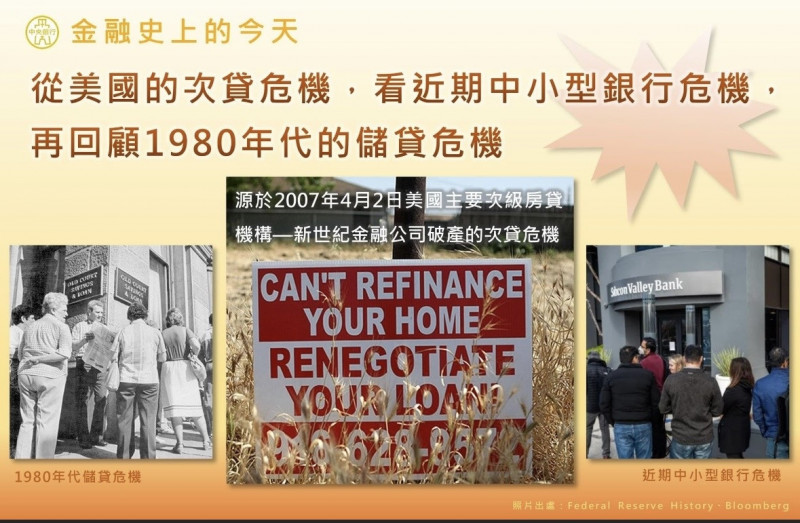

[Reporter Chen Meiying/Taipei Report] The impact of the bankruptcy of Silicon Valley Bank on the US banking system will be the next "Lehman Moment" (Lehman Moment) and become a topic of concern in the financial market.

The central bank pointed out that the international community generally believes that the bankruptcy of Silicon Valley banks will not be similar to the Lehman crisis, but many economists warn that the recent crisis of small and medium-sized banks in the United States is very similar to the savings and loan crisis in the 1980s, and these three crises have The same proximate cause: The Fed raised interest rates sharply.

Silicon Valley silver failure storm is not a Lehman moment

The central bank’s Facebook today looks back on today’s history. The recent collapse of the silver hair in Silicon Valley in the United States has attracted attention from all walks of life. ) institution - New Century Financial Corp. (New Century Financial Corp.) went bankrupt, leading to the subprime mortgage crisis (subprime mortgage crisis), which may expand into a global financial crisis like the collapse of Lehman Brothers (Lehman Brothers) in 2008 ( Global Financial Crisis).

Please read on...

The central bank's Facebook editor pointed out that the international community generally believes that the bankruptcy of Silicon Valley Bank will not be similar to the Lehman crisis.

Because Silicon Valley Bank and Logo Bank are small and medium-sized banks in the United States, they are much smaller than large financial institutions with assets exceeding US$1 trillion; Paul Krugman, a Nobel laureate in economics, also believes that Silicon Valley Bank is not Lehman Brothers. The current situation is very different from the Lehman crisis.

Because Silicon Valley Bank invests in relatively simple U.S. Treasury bonds and MBS, unlike Lehman Brothers in 2008, which held too many highly leveraged derivative financial products, almost all assets in the financial market were sold off. This crisis is unlikely to occur like the 2008 A similar outcome would not have a huge economic impact.

U.S. financial industry crisis caused by Fed's sharp interest rate hike

Even so, some economists still warn that the recent U.S. small and medium-sized bank crisis is very similar to the savings and loan crisis in the 1980s and deserves attention.

In addition, these two crises have the same proximate cause as the outbreak of the subprime mortgage crisis: the Fed raised interest rates sharply.

The Savings and Loan Association (Savings and Loan Association), commonly known as Thrift, began in Pennsylvania in 1831. It was initially established to help people with lower incomes finance the purchase of houses; until 1980 At that time, there were nearly 4,000 savings and loan institutions in the United States, which undertook nearly half of the housing loans in the United States at that time.

However, as Fed Chairman Paul Volcker rapidly raised interest rates to combat high inflation, the value of the fixed-rate mortgages undertaken by the savings and loans fell sharply, but at the same time the cost of funds rose and they had to pay more Only high interest rates can attract deposits, forming a huge negative interest rate spread. Many savings and loan institutions began to generate a large amount of losses, and eventually became unable to repay.

Between 1980 and 1995, more than 1,000 S&Ls went bankrupt and cost American taxpayers more than $160 billion to clean up.

Foreign media reports pointed out that this is very similar to the current problem with Silicon Valley Bank.

Silicon Valley Bank is also a mismatch between the maturity of its assets and liabilities. At the time when the Fed is raising interest rates sharply to fight against high inflation, on the one hand, the value of the fixed-income assets held by the bank has incurred large unrealized losses; on the other hand, the source of deposit funds is facing The pressure caused liquidity problems, and the investment on the asset side could only be forced to pay out the compensation, which eventually led to bankruptcy after the run crisis.

In addition, the commentators also believe that Silicon Valley banks and savings and loan institutions also face the same vulnerability problems, such as loose supervision, improper internal management, high moral hazard, and excessive concentration of a single type of customers (for example, savings and loan institutions are almost completely focused on providing mortgage services. , while Silicon Valley Bank mainly serves technology start-ups), the risks are excessively concentrated.

When savings and loan institutions had financial problems in the 1980s, the U.S. regulatory authorities responded by, in addition to lowering capital provision standards, passing bills that allowed savings and loan institutions to engage in higher-risk consumer loans and commercial loans, and even reduced the financial Institutional deposit insurance was raised from $40,000 to $100,000; insolvent savings and loans were allowed to continue operating, but their financial problems only worsened over time, eventually turning into “zombies.”

As for the bankruptcy of Silicon Valley Bank, in 2018, the Trump administration relaxed the regulatory requirements of the "Todd-Frank Act", that is, regulatory forbearance, which is considered to be an important reason.

While there are many similarities between the current U.S. small and medium-sized bank crisis and the savings and loan crisis, it is generally believed that the most important difference between the two is that the current regulatory authorities have the ability to step in and save the situation, which should help alleviate the impact of these recent bank failures. coming economic impact.

However, "The Economist" recently pointed out that the crisis of small and medium-sized banks in the United States seems to be relieved at present, but if the Fed provides a one-year "Bank Term Funding Program" (Bank Term Funding Program) to extend the period, and the US Congress raises deposits Insurance coverage, without trying to solve the fundamental problems of small and medium-sized banks, the number of zombie banks in the United States may surge.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news