The central bank’s report pointed out that since December 2020, the four adjustments to selective credit control measures have been implemented with good results. Among them, the loan ratio has fallen below 4-5.

(Photo by reporter Chen Meiying)

[Reporter Chen Meiying/Taipei Report] The report of the Central Bank pointed out that since December 2020, the four-time adjustment of selective credit control measures has been implemented with good results, but the overall balance of banks’ real estate loans is still as high as 12.6 trillion yuan. The board of directors and supervisors also stated their position at the press conference that credit control measures will not be loosened for the time being, and there is even room to increase the size.

The Ministry of the Interior invited the central bank and other ministries to give a special report on "the government accelerated the construction of social housing under the high housing prices and public complaints, and the housing policy-related supporting measures to curb housing prices after the amendment of the Law on Land Ownership".

Please read on...

According to the central bank report, in order to maintain financial stability, the central bank pays attention to the risk that changes in housing prices may endanger financial stability, and adopts countermeasures, "not to curb housing prices."

In addition, the international community also believes that due to the wide-ranging impact of interest rate policies, credit control measures should be adopted in response to the risk of housing price fluctuations. In recent years, central banks in various countries have raised interest rates to curb high inflation, and the impact on housing prices is a by-product.

The central bank raised interest rates five times so far last year, with a cumulative increase of 0.75 percentage points so far. Bank lending rates, including real estate-related loan interest rates, have also been raised accordingly, which will also help strengthen the effectiveness of the central bank's selective credit control measures.

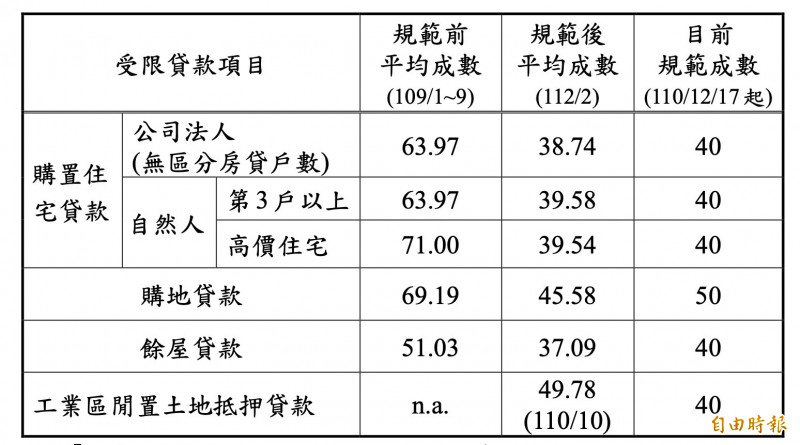

Since the central bank implemented the housing market credit control measures in December 2020, the implementation has been effective, including the cancellation of the grace period for restricted housing loans, which will help curb speculation in the housing market; lowering the loan ratio to 40-50% will help banks control real estate credit risks .

In addition, during this period of time, the growth of bank real estate loans slowed down, the ratio of real estate loans to total loans was roughly stable, and the overlending ratio of real estate loans also remained low.

In order to implement a plan to improve the real estate market, the central bank also cooperates with the Financial Supervisory Commission to strengthen the risk control of real estate loans; the Ministry of the Interior implements real estate real price registration 2.0, adds and revises the regulations on the equalization of land rights, and continues to build social housing; and the Ministry of Finance implements the integration of real estate and land. Taxation 2.0, and urge local governments to rationally adjust the tax base related to real estate, etc. It is expected that the effects of relevant measures will continue to ferment.

In the future, the central bank will continue to pay attention to the situation of real estate loans and the development of the real estate market, review the effectiveness of the implementation of control measures, and adjust the content of relevant measures in a timely manner to promote financial stability and improve banking business.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news