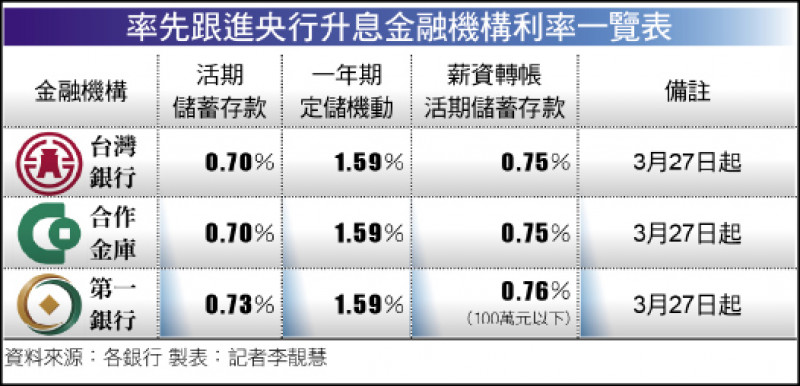

Take the lead in following up the central bank's interest rate hike list of financial institutions' interest rates

Reporter Li Lianghui / special report

Deposit interest rate for digital account projects not affected by interest rate hikes

The U.S. Federal Reserve (Fed) has raised interest rates strongly since last year. Even if it has reached the end of the rate hike, investment experts remind that at this stage, Chinese people’s investment strategies, and even the planning of mortgages and other debts, should be the primary focus of consideration. "Whether to beat inflation" to avoid the shrinkage of funds in hand due to inflation, or the expansion of debt due to interest rate hikes.

Chen Zhaorong, deputy general manager of the consumer finance business group of Mega Bank, pointed out that the first step in the general financial planning advice for investors is to suggest that the public must first reserve 6 months of living expenses as liquidity funds, and there are remaining idle funds Then evaluate deposits, stock deposits or overseas investments.

As for the important data of the assessment, they include: the current annual interest rate of one-year fixed deposits in Taiwan dollars is about 1.5%, the Bureau of Accounting and Statistics estimates that the CPI will increase by 2.16% this year, the annual interest rate of one-year fixed deposits in US dollars is 3.8%, and the yield rate of U.S. bonds is 5%. The above and the possible rise and fall of the US dollar in the future.

Please read on...

The more money you save, the thinner you save, and you transfer to US dollars, and pay attention to the exchange rate risk in U.S. debt

According to Chen Zhaorong's analysis, comparing Taiwan dollar fixed deposits with the current inflation rate, even if the central bank raises interest rates again and puts the money in the bank to receive interest, it will not be enough to accumulate wealth. Instead, it will be eaten up by inflation, and the money will become thinner; U.S. dollars, because the interest rate difference between Taiwan and the United States is 2.3%, at least it can offset inflation; if you invest in U.S. bonds, the interest rate difference can reach 3% to 4%, and you can also increase your income.

For people who do not have US dollars at hand, Chen Zhaorong reminded that at this time, if you transfer US dollars and buy US bonds, you must bear exchange rate risks. Once the US Federal Reserve slows down raising interest rates or even lowering interest rates in the future, the US dollar will weaken, and there will inevitably be exchange rates. The risk of loss is a variable that investors must consider.

Chen Jianxun, senior manager of the Wealth Management Department of Shanghai Commercial Bank, reminded that for investors who like to deposit financial stocks, because some financial stocks have poor dividend distribution conditions this year, it is recommended to choose some targets that are not affected by insurance issues; Commodities denominated in U.S. dollars are more attractive. It is recommended to choose U.S. dollar-denominated bonds, because the U.S. interest rate hike has reached a high point, and the quotations of both long-term and short-term bonds have reached the highest point in recent years. It is recommended to match long-term bonds. "Locked up", when interest rates are cut in the future, there will still be capital gains to be earned.

Chen Zhaorong pointed out that in the current general environment, from the perspective of asset allocation, it is recommended that "bonds are better than stocks". It is recommended that the bond allocation can reach 50% to obtain real interest income that can beat inflation; One, with deposits in hand, you can advance, attack, retreat, or defend.

In terms of stocks, the cycle of interest rate hikes is not good for business operations. After the global stock market fell last year, if you still intend to invest in the stock market, it is recommended to choose technology stocks that have already fallen sharply, and slowly deploy on dips; people who want to save stocks, traditional financial stocks The dividend payout is not good. It is recommended to choose stocks with "cash flow".

Asset allocation advice bonds are better than stocks

As for people who already have mortgages, she reminded them to check the total amount of debt and available funds. Currently, the annual interest rate on mortgages has risen to 2%. In order to avoid the continued increase of the interest burden, it is recommended that people with surplus money in their hands repay the principal as much as possible first. In order to reduce the interest burden; however, if the income from capital investment can fight against inflation, and it is expected that the interest rate will not rise any further, earning higher income from capital investment is also one of the options, depending on how much you can use after repaying the principal and interest of the mortgage Funding depends.

If you are worried that all the funds in your hands will be used to repay the mortgage, you may not be able to raise money when you need it urgently.

Chen Zhaorong reminded that all banks have revolving mortgages or wealth management mortgage products. There is no capital cost when not in use, and interest is only calculated when it is needed, which can be used by mortgage holders for emergencies.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news