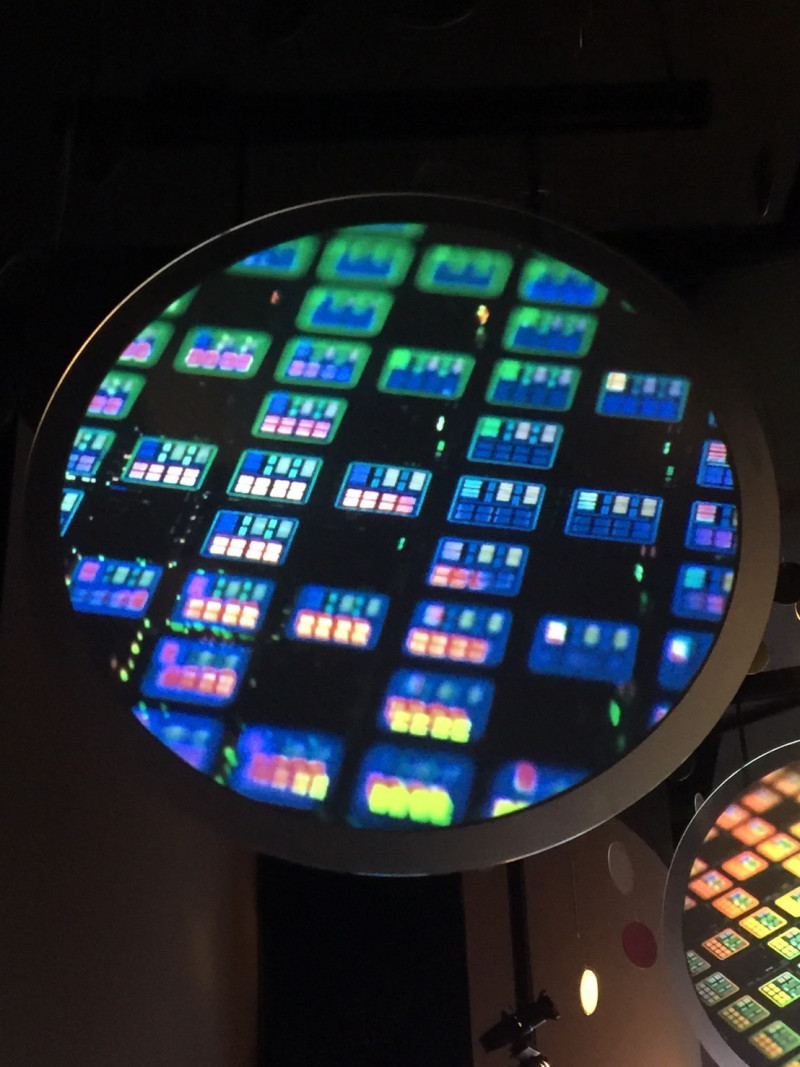

The United States, Japan and the Netherlands have jointly banned the sale of DUV equipment. Experts say that it will be difficult for China's wafer foundry industry to rise (photo by reporter Hong Youfang)

[Reporter Hong Youfang/Hsinchu Report] Yang Ruilin, research director of the Institute of Obstetrics International, ITRI, said that the United States has increasingly expanded its control over Chinese semiconductors. Recently, it has reached an agreement with the Netherlands and Japan to jointly limit the sale of chip manufacturing equipment. These countries are As the supplier of semiconductor equipment, from the perspective of the general direction of the restriction agreement, China will not be able to buy equipment, and it will be difficult for the foundry industry to develop.

According to Yang Ruilin's analysis, lithography exposure equipment is the key to the semiconductor manufacturing process. The United States previously restricted China's extreme ultraviolet (EUV) lithography exposure equipment, cutting off China's development of advanced processes below 7 nanometers. If further restrictions on immersion deep ultraviolet light ( DUV) lithography exposure equipment, Dutch merchant ASML, Japanese Nikon, etc., the sale of equipment to China is subject to control, which will impact China’s inability to buy DUV equipment. Judging from the fact that DUV can produce up to 40 and 45 nanometers , The foundry cannot even expand the production of 40 and 45 nanometer processes.

Please read on...

Yang Ruilin believes that the inability of China's foundry industry to buy DUV means that the middle-level mature process is also hindered. Clients will look to Taiwan and Singapore for capacity replacement, which is beneficial to the duo of wafers with 40 and 45nm processes. Although UMC lacks TSMC's advanced manufacturing process, it is still competitive in the more mature special manufacturing process including 28nm. With the expansion of production and scattered production capacity, it will be beneficial to receive orders from China in the future.

Driven by the continuous buying of legal persons, the stock prices of the foundry duo continued to rise today, and the stock prices of TSMC and UMC rose again today. In particular, UMC returned to the 50 yuan mark, opened at 50 yuan, and the highest intraday was 50.3 yuan, rising 1.05 yuan, an increase of more than 2%, and the stock price hit a new high in more than seven months.

TSMC opened higher and went higher, with an intraday high of 542 yuan, an increase of 12 yuan, and its market value rose back to the 14 trillion yuan mark.

Foreign investors bought more than 10.251 billion yuan of Taiwan stocks yesterday, the 12th consecutive trading day, and bought more than 26,800 shares of UMC. Since the opening of the market in the Year of the Rabbit, in just 3 trading days, the cumulative number of more than 123,000 shares has been bought , ranking No. 1 in foreign capital buying, and investment trust is also rushing to buy.

Foreign capital also changed from overselling to overbuying 9,255 TSMC yesterday, buying nearly 90,000 over 3 trading days.

Foreign investors and investment corporations prefer UMC. Although UMC’s performance this quarter has declined considerably, it is difficult to improve in the first half of the year, and the degree of recovery in the second half of the year is unpredictable. However, because the price has not been lowered, and the technology war between the United States and China continues to expand, it is beneficial to Taiwan Semiconductor. industry, driving legal persons to continue to buy Super UMC, supporting UMC’s stock price to rise.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news