TSMC recently announced to invest and build factories in the United States and Japan. The purpose is to use the United States and Japan to compete with China in terms of security, and at the same time establish a triangular system to widen the gap in global market share between Samsung Electronics and Samsung Electronics.

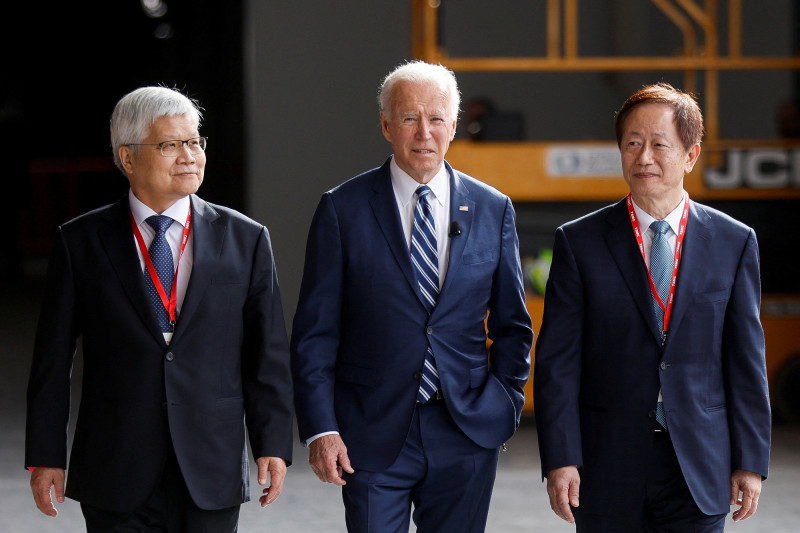

The picture shows that on December 6 last year, TSMC’s Arizona plant held a machine launch ceremony. US President Biden attended the meeting in person and visited the factory with TSMC Chairman Liu Deyin (right) and President Wei Zhejia (left).

(Reuters)

[Compilation of Lu Yongshan/Comprehensive Report] According to South Korea’s BusinessKorea report, TSMC recently announced investment and construction of factories in the United States and Japan. To close the gap in the global market share of OEMs and expand their influence.

According to the report, on December 13 last year, Apple CEO Tim Cook tweeted a photo of him at an elementary school in Kumamoto Prefecture, Japan, and wrote under the photo: "Sony is Apple's partner and manufactures the best cameras in the world. Sensors.” Kumamoto is the area where TSMC and Sony jointly invested in setting up a factory. TSMC is expected to produce Sony products at the Kumamoto factory.

Samsung Electronics also regards sensors as a key product and ranks second in the sensor market, second only to Sony.

The above facts therefore mean that Apple, Sony and TSMC will form a partnership to keep Samsung Electronics at bay.

Please read on...

On December 6 last year, the machine launch ceremony of TSMC's Arizona plant in the United States also demonstrated the technological alliance between Taiwan and the United States. Long Su Zifeng and other political and business figures.

When Pelosi, the former speaker of the US House of Representatives, visited Taiwan last August, she also met with Liu Deyin, chairman of TSMC.

"This reflects TSMC's position in terms of technology security in the United States," said a senior official in South Korea's semiconductor industry.

Analysts pointed out that South Korea is losing its place in the world's semiconductor industry as the semiconductor alliance between the United States, Taiwan and Japan grows stronger.

In 2021, Taiwan announced that it will cooperate with the United States and Japan in the field of semiconductors.

The United States and Japan also established a semiconductor technology alliance last year.

Although the United States, South Korea, Taiwan, and Japan are pushing for a "chip four-party alliance" (Chip 4) to reorganize the semiconductor supply chain, South Korea has not shown active action in this regard.

South Korea's role in the semiconductor value chain formed by the United States, Taiwan and Japan is unclear, experts said.

The United States has an advantage in semiconductor design, Japan has an advantage in equipment, and Taiwan has an advantage in foundry services, but South Korea does not.

TSMC is trying to strengthen its alliance system with the United States and Japan.

This means that the company will compete with China in terms of security through the United States and Japan, and at the same time establish a triangular system to expand its global market share and influence. Combined with large US technology companies such as Huida and Japanese materials, components and equipment companies, the gap with South Korean chipmakers is further widened.

On the other hand, the main memory chip production bases of Samsung Electronics and SK Hynix are in China, which prevents the two South Korean chipmakers from joining the anti-China alliance.

In addition to holding back Samsung Electronics, TSMC's establishment of a factory in Japan also aims to dominate the automotive semiconductor market, which is growing rapidly with the emergence of electric vehicles.

The Japanese government also played an important role in luring TSMC to build a plant in Kumamoto, subsidizing half of the total cost of building the plant.

Samsung Electronics mainly builds the most advanced semiconductor factories in South Korea. Compared with chip manufacturers in other countries, it is at a great disadvantage in obtaining various licenses and subsidies.

TSMC announced in December last year that it would expand its investment in Arizona to US$40 billion, more than double the original investment amount, and more than double Samsung Electronics' US$17 billion investment in Texas.

Some analysts predict that this investment will further widen the market share gap between TSMC and Samsung Electronics.

According to expert analysis, TSMC is sandwiched between the United States and China, and it is also taking advantage of this geopolitical crisis. By building factories in the United States and Japan, the company can ease and spread the risk of being attacked by China, and use a stable supply chain to ensure more U.S. daily customers.

Due to the increasing demand for semiconductors, Taiwan's production facilities and human resources alone cannot meet all future needs. Therefore, with the support of the United States and Japan, TSMC has secured future factories and human resources in advance.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news