Invest in the five major channels of gold

Reporter Chen Meiying / special report

Gold has a chance to challenge the high of US$2,000 per pound this year, and the public can also buy some gold on dips as a safe haven.

(Reuters)

Last year, the Ukrainian-Russian War broke out, inflation was heating up, the United States raised interest rates aggressively, and the strong U.S. dollar dominated. The international gold price was oversold and oversold. Looking forward to the Year of the Golden Rabbit, experts said that the trend of gold this year will be upward, and there is a chance to challenge the high of 2,000 US dollars per British tael point.

The easiest way for the petty bourgeoisie to buy gold is to regularly deposit a fixed amount into a gold piggy bank. Since gold is an alternative to the U.S. dollar, people with a full hand of U.S. dollars can also buy some gold at low prices as a hedge.

Yang Tianli, manager of the Precious Metals Department of Taiwan Bank, said that after the US Federal Reserve (Fed) released a signal to slow down interest rate hikes in November last year, the US dollar weakened. At that time, some international investment institutions predicted that the gold price would exceed US$3,000 this year. Consultation, is the price of gold really so bullish this year?

He said that the price of gold is indeed bullish this year, and there is a chance to challenge the high of $2,072 set in August 2020, but if it wants to break through $3,000, unless there is severe stagflation in the global economy and stock prices collapse.

Please read on...

Fed turns dove, dollar weakens, and gold prices are bullish this year

Chen Youzhong, chief foreign exchange strategist at Taishin Bank, analyzed the reasons for bullish gold prices this year. He pointed out that gold and the U.S. dollar are substitutes. When inflation cools down, the Fed’s interest rate hikes slow down, and the strong U.S. dollar is over, the U.S. dollar will fall, and gold prices will have a chance to go up. superior.

In addition, the Ukrainian-Russian war has not yet stopped, and global geopolitical risks are still high; although US inflation has dropped from a high of over 9% to below 7%, it is still at a high level, and gold can resist inflation.

Finally, under the confrontation between the United States and China, in order to reduce its dependence on the US dollar, China sold its US debt to buy gold. As long as China, the largest buyer, continues to hoard gold, the price of gold will be supported.

From the perspective of the technical line, Yang Tianli said that the gold price has repeatedly tested the bottom from September to November last year, and has hit "three legs", forming a compound bottom. After the Fed released the message of slowing down interest rates in November, the gold price immediately reversed It rose from US$1,614 to US$1,800 in just half a month, and then consolidated sideways at US$1,800. This is an obvious rising and converging pattern.

Yang Tianli believes that after the price of gold rose above US$1,900 a year ago, the price of gold will challenge the first target range of US$1,960. If US$1,960 stands above, there is a chance to go to the second target range of US$2,040 to US$2,070. cloudless.

However, although the price of gold is bullish this year, unless the pockets are deep enough, Yang Tianli recommends to "fight and go" and operate in a swing mode to reduce risks.

Petty bourgeoisie can choose gold passbook and gold ETF for investment

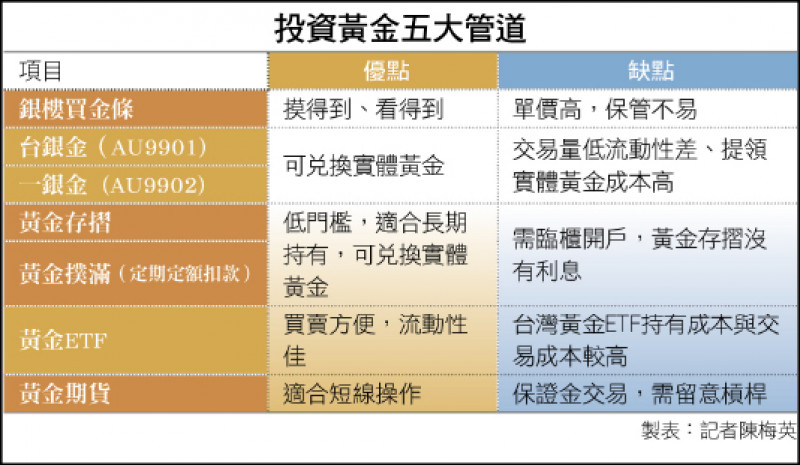

For petty bourgeoisie, the easiest tools to invest in gold are gold passbooks and gold piggy banks that can be deducted regularly. In addition, gold ETFs that can be bought with stock accounts are also good choices, but you should pay attention to the volatility of gold ETFs in the market.

As for the gold funds favored by Chinese people, one should be careful that the investment portfolio is mainly gold exploration or stocks of mining companies. The trend of gold funds may not be consistent with the price of gold, and the fluctuations are relatively large.

In addition, gold futures are suitable for professional and risk-bearing investors.

Yang Tianli said that if the public's investment tools are mainly fixed deposits, it is recommended to allocate 4~6% of gold assets; if they are stockholders, they can allocate 10% of the funds in gold to diversify investment risks.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news