In 2023, Taiwan's semiconductor output value will be 5 trillion.

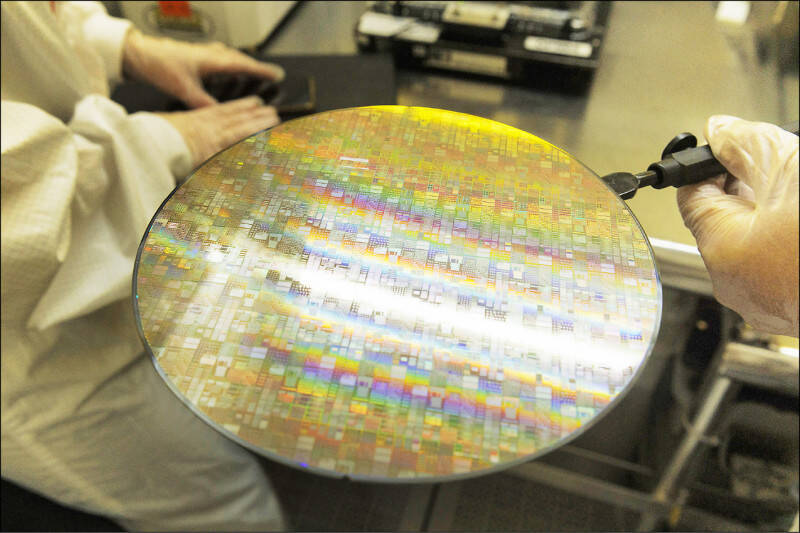

(Schematic, Bloomberg)

The post-epidemic era is accelerating digital transformation, boosting business opportunities in 5G, AI and high-performance computing, and the semiconductor industry continues to be the focus of global attention.

In the semiconductor session of ITRI's "Looking at the 2023 Industry Development Trend Symposium", it analyzed the issues of global semiconductor supply chain restructuring and Taiwan's key role under factors such as digital transformation, sustainable development, and geopolitics.

In 2022, the world will pay close attention to the semiconductor industry. Fan Zhehao, manager of the Industrial Technology International Strategic Development Institute of the Industrial Technology Research Institute, pointed out that the post-epidemic era will change the work and life styles; Attracted attention; geopolitics is prevalent, subsidy policies of various countries have been released one after another, the United States, Europe, Japan, and South Korea are actively developing semiconductor independence; continuous technological innovation drives advanced manufacturing processes and advanced packaging; corporate ESG sustainable development, etc., are all related to the growth and decline of the semiconductor industry.

Please read on...

Taiwan Semiconductor's 5 trillion output value reached ahead of schedule

Despite the turmoil in the global economy, there are still innovative applications and business opportunities such as 5G, AI and high-performance computing (HPC).

In 2022, the output value of Taiwan's semiconductor industry is estimated to reach NT$4.7 trillion, with an annual growth rate of 15.6%, and double-digit growth for three consecutive years. Compared with the global semiconductor industry output value of approximately US$618.5 billion, an increase of 4%, the performance is impressive.

"Advanced manufacturing processes, automotive chips, and net-zero emissions are the main growth drivers for Taiwan's semiconductor industry," said Fan Zhehao. Taiwan's semiconductor industry will reach the milestone of NT$5 trillion in output value in 2023 ahead of schedule, growing by 6.1%; but here At the same time, the global semiconductor market is affected by inflation and other factors, and the growth rate has slowed down sharply. Next year, the global semiconductor market may experience a negative growth of 3.6%. Automotive use will be the driving force for growth in the next few years.

Automotive semiconductors will be the third largest application in 2026

Zhong Shuting, an industry analyst at the Institute of Obstetrics International, ITRI, pointed out that due to the decrease in shipments of terminal devices such as PCs and smartphones, the proportion of semiconductors used in communication and computing will drop sharply, but they will still be the two major semiconductor applications in the world. Automotive semiconductors will become the third largest application, and the compound annual growth rate of automotive semiconductors is estimated to be 13.8% from 2021 to 2026.

Intelligentization and electrification are important trends in vehicles. "Autonomous driving and ADAS and other intelligent vehicle networking trends will push automobiles into a new generation of vehicles that carry many applications in life, and also increase the number of chips per vehicle," Zhong Shuting said.

The cost of chips per car is rising at an annual growth rate of 8% to 10%. In 2020, semiconductors will account for an average of $489 per car, and will exceed $716 by 2025.

The automotive supply chain ecosystem will also change, and non-traditional automotive suppliers will also have opportunities to enter.

Zhong Shuting said that in the past, the automotive supply chain was relatively closed. In recent years, automakers have also begun to develop their own automotive chips, and many computing processor suppliers have gradually entered the automotive market. Taiwan's chip industry has great opportunities.

It is recommended to use Taiwan's professional chip design and geographical advantages to assist in the development of customized chips, or start from the perspectives of Internet of Vehicles communication and image processing.

In addition to car use, another major driving force comes from the Metaverse. Since all data and images from the terminal to the cloud require chip processing, "Semiconductors are the core foundation of the seven major markets in the Metaverse," Zhong Shuting said.

However, the scope of the metaverse is huge and involves the vertical distribution of markets in various industries. At present, the global metaverse is still in the stage of individual development and multi-party attempts. She suggested that semiconductor manufacturers can start from their own core technologies and explore in multiple ways with a more open attitude. According to the needs of the company, interact more with industry players in different fields, and make long-term layout.

Regardless of the application fields such as vehicles, metaverse, AI or unmanned vehicles, the demand for HPC and the development of technology are accelerating. HPC has entered the daily application from the field of research and laboratories. In the first quarter of this year, TSMC’s HPC single-quarter Its revenue surpassed that of smartphones for the first time, and major international manufacturers are also actively developing HPC chips and continuing to deploy related application markets, which deserves attention.

Both IC design and manufacturing output value hit new highs

As semiconductors are adopted into more application markets, the IC design industry is also driven to grow upwards.

This year, the output value of Taiwan's IC design industry will reach NT$1.2 trillion, with an annual growth rate of 1.8%. Next year, it is expected to grow another 5.1%, reaching a record high of NT$1.3 trillion.

Huang Huixiu, an industry analyst at the Semiconductor Research Department of the International Institute of Obstetrics and Obstetrics of the Industrial Technology Research Institute, said that although major environmental factors such as global inflation, the Russian-Ukrainian war, and China’s blockade have affected terminal demand, semiconductor manufacturers still use the most advanced processes to compete with each other in the market, including Intel. , Advanced Micro Devices, Qualcomm, Huida, MediaTek, etc. have all adopted the 4nm process for production.

And due to the advancement of advanced manufacturing processes, the global wafer foundry will exceed the 100 billion US dollar mark in 2022, reaching the peak of annual growth. The annual output value of Taiwan's wafer foundry will reach NT$2.56 trillion, an increase of 31.7%, and it will be firmly seated in the global wafer industry. OEM leader.

However, next year’s economic benefits from the epidemic will gradually decline. At the same time, due to the impact of the Russia-Ukraine War and high global inflation, the consumption of terminal electronic products will weaken. It is expected that the growth of global foundry will be greatly reduced in 2023.

Taiwan's IC manufacturing industry will reach NT$2.78 trillion this year, with an annual growth rate of 24.8%, the largest growth in the past 10 years.

Under the wave of net-zero emissions, the semiconductor industry also aims at sustainable development and promotes the development of advanced technologies, including low-carbon manufacturing, green power layout and low-carbon supply chain. The decarbonization of the future supply chain will be critical to the competitiveness of the semiconductor industry .

(This article is reproduced from Industrial Technology and Information Monthly)

The proportion trend of semiconductor application category.

(Picture provided by ITRI)

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news