Citigroup said technology stocks are looking for a recovery in the second half of 2023 or 2024.

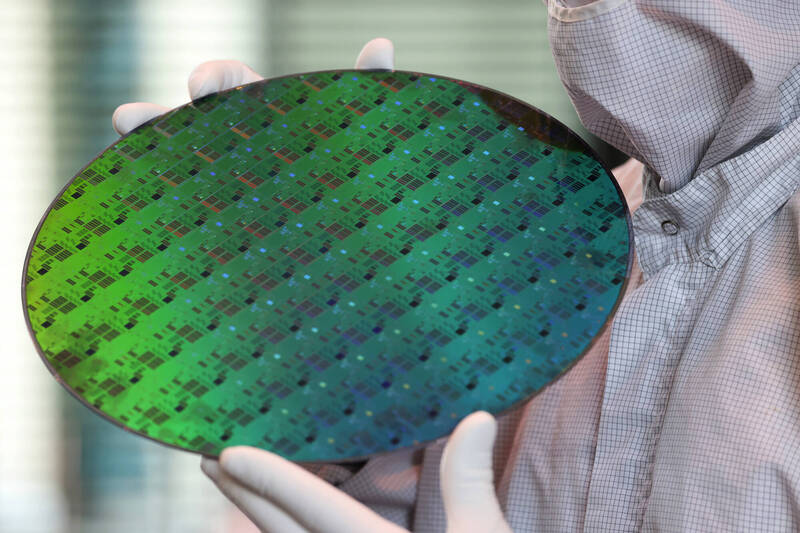

(Bloomberg file photo)

[Financial Channel/Comprehensive Report] Citi reports that although technology companies continue to be pessimistic about order visibility and inventory digestion may continue to drag down recent trends, Citi believes that investors are relatively more optimistic and look forward to the second half of 2023 or 2024 recovery.

The supply chains of personal computers (PCs), smartphones and consumer electronics may go down further, but it is generally expected that the first half of 2023 will bottom out, and the outlook for the second half of the year will be better.

Citigroup predicts that the trough of semiconductor foundry will appear in Q2 of 2023.

For fabless semiconductor companies, Citi recommends further focus on profits in view of rising upstream costs and obsolescence of existing inventories.

In terms of ABF substrates, Citi believes that the supply and demand situation will remain balanced in the first half of 2023, and the elastic high-end demand will offset the weakness of other parts. The recovery of demand in the second half of the year and the launch of new platforms will be the main momentum of ABF in 2023. .

Please read on...

Companies including Xiangshuo (5269), Xinhua (5274) and Realtek (2379) mentioned that their customers have recently lowered their orders due to demand uncertainty.

The demand of data centers and hyperscale enterprises is still relatively flexible, which will support Xinhua's sales to achieve double-digit growth next year.

For the PC supply chain, there is no sign of recovery in the short term.

In terms of smartphones, although MediaTek (2454) hopes to restock in Q1 of 2023, the current visibility is still low.

MediaTek expects 5G penetration to grow further, which will support the company's better average selling price.

MediaTek previously placed an order for Intel wafer foundry, and Citi expects the cost of the foundry to rise, especially for advanced process nodes, which may lead to greater profit pressure for smartphone and PC fabless semiconductor companies next year.

As the wafer inventory level is still high, the foundry capacity utilization rate will be on a downward trend in Q1 of 2023, and the average price of back-end foundries and OSATs (outsourced packaging and testing foundries) will decline.

Even so, Citigroup noted that the price increase trend of TSMC (2330) is still stable.

In terms of geopolitical risks and relocation of production bases, considering factors such as inefficiency, high cost and lack of research and development, we have not seen companies willing to actively invest in regions outside the United States or Asia.

Investors are also paying close attention to the supply and demand of ABF carrier boards, as well as the quotations in 2023. Given the overall uncertainty, ABF peers have limited understanding of 2023, and expect the current supply and demand balance, and the quotations in the first half of 2023 will remain stable.

High-end applications such as servers are the key to supporting production capacity.

Kinsus (3189) has not seen any signs of recovery in PCs, notebooks or GPUs (graphics processing units).

Xinxing (3037) is still waiting for the launch of the new server platform of its major customers.

Whether we can return to the state of short supply in the future will depend on the demand for servers, the recovery of computers, and the mass production of new platforms.

Citigroup expects that the revenue decline of fabless semiconductor companies will continue, and after inventory adjustments, there will be greater price pressure and profit revisions.

As foundry capacity bottoms out in Q2 of 2023, Citigroup expects that foundries will gradually recover in the second half of 2023.

For carrier board manufacturers, Citigroup believes that PC, notebook or server inventory adjustments have been reflected in prices, and in the long run, HPC (High Performance Computing) will be able to support ABF demand.

Grasp the pulse of the economy with one hand I subscribe to Free Finance Youtube channel

Already added friends, thank you

Welcome to 【Free Finance】

feel good

Already liked it, thank you.

related news