Amid war, political turmoil and economic uncertainty, it is difficult to predict when the consumer market will bottom and when chip demand will rebound.

(Reuters file photo)

[Financial Channel/Comprehensive Report] A few months ago, the world was still worried about the shortage of semiconductors, but now the situation has changed, and the sharp drop in demand has become a problem for the semiconductor industry. Due to the rapid shrinking of demand for consumer electronics products, including TSMC, Manufacturers including Advanced Micro Devices (AMD) and huida experienced order cancellations and unsold inventories, also impacting industry revenue growth and capital spending.

The wave of demand slumps contrasts with previous chip shortages that have wreaked havoc on makers of cars, smartphones, computers and other goods that depend on advanced electronics.

Analysts at ICwise, a market research firm for the semiconductor industry, said the business situation has turned so quickly that chip designers struggled to find capacity last year, but now they are finding they can't sell chips.

The multi-billion-dollar smartphone industry has cut at least three rounds of orders from chipmakers so far this year, an industry veteran said.

Please read on...

Weak chip demand, order cancellations, inventory build

TSMC, the world's largest chip foundry, faced a drop in orders from its four largest customers, reflecting slowing global demand.

Supermicro, NVIDIA, Qualcomm and MediaTek cut chip orders with TSMC, JPMorgan said in a report.

TSMC last week reported record quarterly profit growth for the July-September quarter, but also warned that the entire semiconductor industry could decline in 2023 and cut its capital spending forecast for this year by 10%.

Other semiconductor companies are also facing a dire situation.

Super Micro lowered its revenue forecast for the third quarter, citing significant weakness in the PC market.

Intel, Alpha and Micron have all issued sluggish outlooks.

In the first half of 2022, macroeconomic headwinds and multiple black swan factors led to a collapse in consumer electronics demand, with smartphones and PCs bearing the brunt.

Micron predicts that global PC shipments will decline by 10-20% in 2022, while the global smartphone market will decline by less than 10%.

Shrinking demand for smartphones and PCs

Market research firm Strategy Analytics estimates that global 5G smartphone shipments will drop by as much as 150 million units by 2022, and 5G mobile phone chip demand will drop by 100 million to 120 million units.

Smartphone makers are stuck with high inventory management.

It is estimated that as of the end of June, the global inventory of finished smartphones reached 200 million units.

Phone makers have also accumulated large inventories of components.

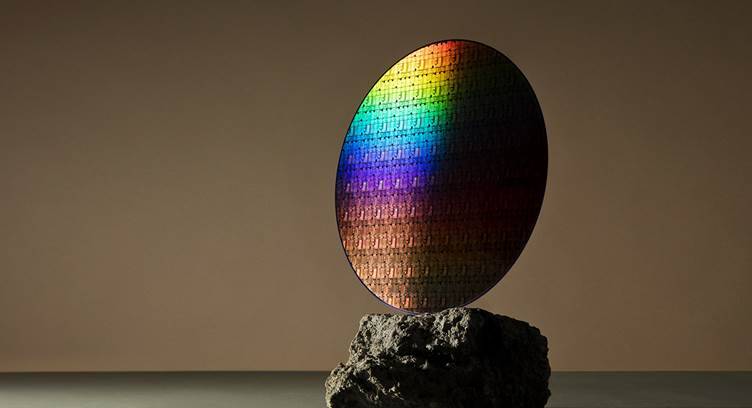

The demand for wafers for smartphones and personal computers (PCs) accounts for more than half of the global foundry capacity.

At present, automotive chips are still in short supply, but they account for less than 10% of the overall chip market.

Smartphones and personal computers have a decisive impact on the semiconductor industry, an analyst said.

The PC market is also facing declining demand.

Gartner estimates that worldwide PC shipments totaled 72 million units in the second quarter of 2022, down nearly 13% year-on-year, the biggest drop in nine years.

Amid wars, political turmoil and economic uncertainty, it is difficult to predict when the consumer market will bottom and when demand will rebound.

Dale Gai, head of research at Counterpoint Research, said wafer demand in 2023 is expected to be flat or slightly down from 2022, while capacity is expected to grow by about 7% next year, suggesting a supply glut.

However, demand for advanced smartphone chips continues to expand, reflecting strong demand from premium brands including the iPhone, and demand across the industry may bottom in 2024.

Grasp the economic pulse point with one hand, I subscribe to the free finance Youtube channel

I'm already a friend, thanks

Welcome to 【Freedom Finance】

Feel good

Liked already, thank you.

related news