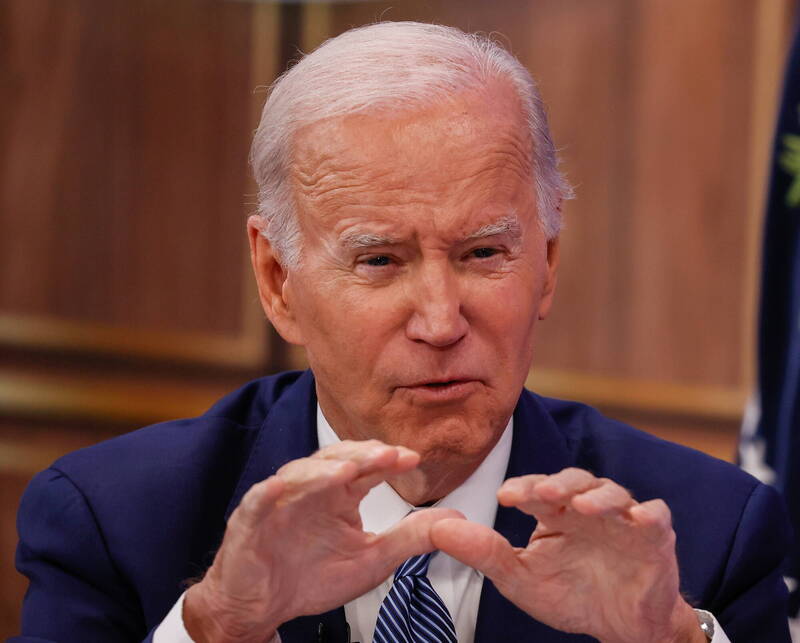

U.S. President Joe Biden said a recession could occur in the U.S., but any recession would be "very mild."

(European News Agency)

[Financial Channel/Comprehensive Report] U.S. President Biden said on Tuesday (11th) that there may be an economic recession in the United States, but any recession will be "very mild", emphasizing that the U.S. economy is resilient enough to weather turbulent times.

In his first exclusive interview with CNN after taking office, Biden said that he does not believe that there will be a recession in the United States. If it does, it will be a slight recession, only a slight decline.

Investors, economists and banks have all warned that the U.S. could slip into recession in the coming months, as inflation fears and the increased likelihood of a sharp rate hike by the Federal Reserve have not only spooked Wall Street but also pushed the envelope. Higher long-term bond yields.

Please read on...

Meanwhile, the International Monetary Fund (IMF) cut its forecasts for the global economy again on Tuesday, warning that "the worst is yet to come" and the economic outlook will deteriorate.

The IMF also revised its U.S. economic growth forecast to 1.6 percent in 2022 and maintained growth at 1 percent in 2023.

Biden said that although the forecasts of international organizations have attracted widespread attention, the ability of the United States to prevent inflation so far has given him confidence in the future of the economy.

Biden pointed out that every six months they look to the next six months, and then guess what will happen, but it does not happen as expected.

The Federal Reserve has not officially predicted a recession, but Fed officials have admitted that unemployment is expected to rise next year, and Chairman Jerome Powell has warned that sharply higher interest rates could be painful for the economy.

The latest U.S. inflation data will be released on Thursday (13th), the last before the U.S. mid-term elections.

Economists' median forecast was for an 8.1 percent annual growth rate, the weakest since February.

The Fed's next monetary policy meeting will take place in early November, just days before the election, when the Fed may raise interest rates by 3 yards (0.75 percentage points) for the fourth time.

Master the economic pulse point with one hand, I subscribe to the free finance Youtube channel

I'm already a friend, thanks

Welcome to [Freedom Finance]

Feel good

Liked already, thank you.

related news